If you have been living under a rock, the world’s richest man bought one of the world’s largest social media sites, and the internet promptly imploded about it.

Strong armed into purchasing Twitter for an eye-watering and vastly overpriced $44 billion, Musk took the company private and quickly set to work on his vision of turning Twitter into the de facto online town square, citing its potential to be a bastion of free speech.

One of the major problems Musk and the new Twitter board faces is monetisation and profit generation. Twitter has largely been lagging behind other platforms like Facebook, Instagram and Youtube in generating revenue through online advertising, turning over $5 billion in 2021, whilst ad giant Meta (then Facebook) had a whopping $118 billion in ad revenue and Google crushing $150 billion. This comparatively paltry ad revenue has meant that Twitter has historically had problems with being profitable, having $220 million in net losses in 2021, and is surely to hit another loss in 2022 with no real change in revenue from 2021, advertisers fleeing from Musk’s Twitter and all the hubbub around the acquisition slowing growth and innovation.

So what is Elon’s plan for increasing profits? Well firstly, he fired 50% of the workforce to cut down on the costs, which is drawing an incredible amount of ire, ironically most of it on Twitter.

But what about revenue generation? Musk’s push for free speech led to a 500% increase in racial slurs being used on the platform, which first and foremost is disgusting and wrong just on a basis of human ethics, but it also will drive brand-protecting advertisers away from a platform that already has a hard time getting advertisers to write checks.

So Musk is diversifying and has introduced a highly controversial subscription based model for verification, charging users $8 a month for a coveted blue tick (which isn’t even blue by the way). Previously, the blue tick was bestowed by the Twitter team to notable public figures so users could distinguish real celebrities and public figures from bad actors impersonating them.

It appears that a verification system will still be in place, with the Twitter team labelling notable users with a grey “official” badge, however the blue check is now something any user can get by subscribing to Twitter Blue.

It’s a risky move for sure, but Musk is known for somewhat risky moves and this blog is a deep dive into the idea of a subscription based social platform and whether this is Twitter’s key to profitability moving forward.

It’s hard to say right now as there’s limited data on how many people have signed up for Twitter Blue and I imagine that past financial statements are pretty out of date now that 50% of the workforce has been fired and the CEO of a rocket company is now in charge, but we can do a little bit of vague maths on the Q2 financial figures to try and figure out the gap that Musk is trying to close.

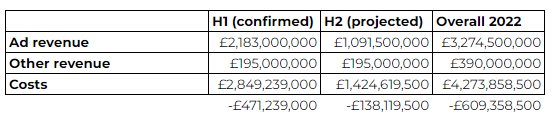

Twitter in Q2 2022 reported that in the first six months of 2022 it had a $2.84bn operating cost, and generated $2.37bn in revenue, ending up with an overall $471 million net operating loss. (which is actually way better than them losing over a billion in 2020). So how is Musk going to combat that in Q3 and Q4 and in 2023?

Firstly, he cut costs, so let’s factor that in. Let’s say hypothetically that with the layoffs, Musk has knocked 50% of operating costs of Q3 and Q4 by announcing layoffs (don’t forget they still have server and architecture costs, office leases and bills to pay so it most likely won’t be a full 50% reduction in operating costs). That leaves overall operating costs at $4.27bn ($2.84bn in H1 and $1.42bn in H2). This aligns with Musk's plans to take a billion off the operating cost so checks out logic wise.

Now the predicted cost has been very hastily cobbled together by an under qualified moron (again this is super rough and is just to give an idea of Twitter’s financials, I didn’t go to school for this, please stop yelling) let’s look at revenue.

In H1 2022, Twitter made $2.18bn from advertising and $195 million from data licensing and subscription. This ad revenue is 100% going to dip in 2023 as Musk’s emphasis on free speech has already scared advertisers away.

In May of 2022, there were 3,900 advertisers on Twitter, and by September that number was 2,300, which is a 41% decrease in advertisers. A small handful of advertisers account for 74% of Twitter's total ad spend, so it’s anybody's guess how that ends up impacting ad revenue so let’s just call it a 50% decrease in ad revenue in H2 (even though it’s likely if big advertisers pull their ads long term, again that could be way north of 50% of ad revenue gone). If their data licensing still ends up being the same amount, that’s $3.27bn in projected revenue for 2022. So overall that’s :

Now I know he's not trying to recoup all those losses by the end of this year, but by those figures, going into 2023 Twitter will be operating at a loss of around $270 million a year with it's current revenue streams if my 2022 H2 predictions are right. This a huge reason Musk is looking into different monetisation options. So how profitable can these monetisation efforts be?

The new subscription costs $7.99 a month, which equates to $95.88 a year per user. Twitter has 237.8 million monetizable daily active users worldwide. To make $300 million from these users, Twitter needs about 3 million people to sign up for Twitter Blue for that scheme to plug the gap between operating costs and revenues. This is around 2% of its user base, which on the surface definitely seems like an achievable metric. However, with Apple taking 30% of any in-app purchase and accounting for 45% of the smartphone market and factoring in taxes on top of that (which I honestly have no clue about), it’s probably going to around the 5% mark which need to sign up to make sure that scheme is responsible for closing the gap and ensure profitability (especially if there is legislation against them, which was a huge problem for profitability in 2021).

Again, this is very possible but hinges on the value of the proposition that Twitter Blue offers. LinkedIn offers a subscription model and roughly 39% of their users pay for some form of account. LinkedIn Premium, however is very clearly outlined as a business investment as it’s good for salespeople and people looking for jobs or candidates, and that’s why it’s crucial that Twitter highlights clearly and concisely to users the benefits of Twitter Blue to hit the number it needs to hit. Hard to do with reduced marketing teams.

Currently there are 400,000 verified accounts (verified the old way) on Twitter which means Musk needs to force a roughly 620% increase in the amount of Twitter accounts with the blue tick to hit 2% of users and to hit 5% he needs to increase subscriptions by 2872%. This seems like a very risky gamble, and again it’s imperative that Twitter Blue is as good as outlining its utility as LinkedIn is with its premium offering, and even then it’s going to be incredibly tough to drive such large growth with slashed teams and morale in the toilet.

Not everything is about money however, and there are some problems that the new scheme might (and already is) facing.

The first is the reason verification was even introduced on Twitter in the first place : safety. Already people are taking advantage of the new blue check system to impersonate public figures, and this could have real consequences amongst the non-tech savvy. There’s a reason that Musk waited until after the US midterms to roll a lot of his schemes out : he is acutely aware of the power of Twitter in public discourse. Now with anyone being able to buy a blue check without ID verification, that could cause serious problems.

Also it’s untold how the layoffs will affect innovation, accessibility and a whole host of other features integral to running a successful platform. You can’t lay off 50% of your workforce and expect productivity to increase, so Twitter will most likely be slower to react, and in terms of a data security standpoint, less safe than previously. If that blows up in their face, they could face costly litigation down the line, again affecting their bottom line. And this isn't even mentioning staff retention, which could cause a brain drain from Twitter HQ to other tech platforms.

Another problem that’s not specifically tied to the blue check scheme but definitely has its part to play in the Twitter story is the rise in hate speech. There were reports that Musk’s takeover and emphasis on free speech emboldened white supremacists and hate groups, leading to a rise in racial slurs being used on the platform. Again some things are bigger than money, and making sure that your platform is safe to use, has safeguards in place for vulnerable users and doesn’t promote hate is something that shouldn’t be measured with balance sheets but instead done out of a sense of duty and compassion.

I’ve been reading Steve Jobs by Walter Isaacson recently, and one of the things Isaacson reflects on is what people close to Steve called his “reality distortion field”. This refers to Steve’s ability to will things into reality just by saying them and acting as if they were true. Musk has a certain part of that, like a diet coke version of a “reality distortion field”. He is able to say things that don’t come into reality (like the Cybertruck or the Hyperloop) but get the credit as if they did. It’s highly plausible that Musk just keeps acting as if it’s all going swell, and his followers and fans just accept that it is.

In my opinion, I am not adverse to the idea of a platform opening up a new revenue stream through subscription, and I actually think it’s a good idea to make your main customer your user rather than advertisers (ironic as I work pretty heavily in advertising I know). However, I think this scheme is relatively dangerous, ill thought out and has been rushed out the door to grab headlines. I will be interested to see it play out, and I am even more interested to track the progress of Mastodon, an app that is hoovering up users who leave Twitter. The only thing that is known for sure : it's going to get a lot weirder before it gets more normal!

Load comments

Comments

No comments yet, be the first!